Here we are in Week 4 of an upside world that has sideswiped most of us. Since mid-March, restrictions and measures related to COVID-19 have rapidly escalated. While the first stages focused on public health and safety, in very short order, businesses and personal finances began to be affected. It is clear that these challenges will become worse before they get better. In an effort to combat these effects, all levels of Government have released a series of financial measures starting March 15. These measures have changed and been updated. This is a summary to April 15/20

Personal Tax and Trust filings

- For individuals, the filing date for 2019 T1 tax returns are deferred to June 1/2020 from April 30th

- For unincorporated business owners (and their spouses) the filing due date remains June 15, 2020 (currently)

- For Trust filings, the filing date for trusts with a year end of December 31, 2019 year end, will be deferred from March 31, 2020, to May 1, 2020

- Electronic signatures will be allowed to authorize tax filing by tax preparers on behalf of taxpayers

- Payment of tax amounts owing will be deferred until Sept 1/2020, for any income tax amounts that become owing after March 17, 2020 and before September 2020; this applies to tax balances due, as well as instalments, under Part I of the Income Tax Act (no interest or penalties will accumulate on these amounts during this period)

- Suggestion: File as early as possible to help your cash flow. File as soon as possible if you will be receiving the Goods and Service Tax Credits (GSTC) or the Canada Child Benefit to ensure your entitlements to the 2020-2021 benefits are determined appropriately. Given that electronic signatures are allowed this year for authorization of tax filings and much of the personal information is now available via the CRA portal, you should be able to file your tax return from a distance with a tax preparer. (Let me know if you need assistance)

For older Canadians

- For those receiving Registered Retirement Income fund (RRIF) payments, the minimum withdrawal amounts from RRIFS will be reduced by 25% for 2020 because volatile market conditions have impacted retirement savings. Similar rules will apply to individuals receiving variable benefit payments under defined contribution Registered Pension Plans

- GSTC Payments - for older Canadians receiving OAS, a one time payment of up to $300 to offset increased living expenses

- GSTC Payments - for older Canadians receiving Guaranteed income supplements (GIS), a one time payment of $200. For those receiving OAS & GIS, they will therefore receive a $500 in a one-time payment

For taxpayers with low- and modest-income

- GSTC Payments-A one-time special payment was made in April/20 to double the maximum annual GSTC payment amount for 2019/2020. The average boost to income will be close to $400 for single individuals and close to $600 for couples.

- Enhanced Canada Child Benefit (CCB)-A one-time increase in the maximum annual Canada Child Benefit CCB will be made for the 2019-2020 benefit year in the amount of $300/child to be received in May 2020,

- One-time payment to Ontario parents of $200/child up to 12 years of age & $250 for those with special needs

- A doubling of the Guaranteed Income System (GAINS) payment in Ontario for low income seniors

Income support for those losing their employment/self employment income

Employment Insurance would be applicable before CERB begins March 15. Then all payments will be paid by CERB. Reporting under EI may continue but the payments will be based on $500/weekly until Oct 3 For those who have been temporarily laid off and have applied for EI, those applications will be moved over to the Canada Emergency Response Benefit Program For those who are sick, quarantined or have been directed to self-isolate and have applied to EI, a doctor’s note will be waived and applications will be moved to CERB automatically for payment.

Canada Emergency Response Benefit (CERB)

The earlier announced Emergency Care Benefit and Emergency Care Support Benefit were merged into the Canada Emergency Response Benefit. CERB provides up to $500/weekly or $2,000 a month for up to 4 months or 16 weeks (comparable to EI sick benefits) for Canadian residents who are:

- Individuals who stopped working due to COVID-19 and don’t have paid leave or other income support

- Wage earners as well as contract workers and self-employed who would not qualify otherwise for Employment Insurance

- Individuals who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19

- Workers who are still employed but are not receiving income because of disruptions to their work situation due to COVID-19

- Individuals with children who must stay home without pay to care for children that are sick or at home due to school closures

You cannot quit a job voluntarily to get CERB. If you need help determing your eligibility for CERB there is a good FAQ page on the CRA website

Applications for the CERB began April 6/ 2020. Individuals will be required to re-apply or “attest” as to their income situation and status for CERB every 4-week period for a maximum of 16 weeks. The program will run until Oct 3/20. While individuals can only receive a maximum of 16 weeks in total, the 16 weeks do not have to be taken consecutively. You might be eligible and receive CERB in Period 1 but not in Period 2 but be eligible again in Period 3. Applications will end Dec 2/2020.

Here are the eligibility periods:

- March 15, 2020 to April 11, 2020

- April 12, 2020 to May 9, 2020

- May 10, 2020 to June 6, 2020

- June 7, 2020 to July 4, 2020

- July 5, 2020 to July 18, 2020 etc

Orignally it was stated that you couldn’t receive CERB if you had ANY work income in a period, but as of April 15/20 that changed. Individuals can earn up to $1,000 and still be eligible for CERB. This fills a gap for those who were being penalized for making small amounts of money but not enough to survive. Individuals are eligible for CERB when they have stopped working or will stop working because of COVID-19 and have not earned more than $1,000 in employment and/or (net) self employment income for 14 or more consecutive days within the 4 week benefit period (or earned more than $1,000 employment or (net) self employment income for the entire 4-week period in subsequent applications) In determining what the $1,000 income threshold the following items "count" tips earned while working, honoraria for volunteers, royalties paid to artists and non-elgible dividends received. However, pensions, student loans and bursaries are not included in the $1,000 threshold. Business owners would consider the following when determining their eligibility for CERB: Pre-tax salaries, (net) pre tax income (gross income less expenses) and dividend income (non eligible dividends)

Eligibility requirements for CERB include being a Canadian resident over the age of 15 and having $5,000 in employment income or self-employment income or maternity/paternity leave benefits for 2019 or in the 12-month period preceding the day they make the CERB application. This $5,000 requirment now also includes non eligible dividends.

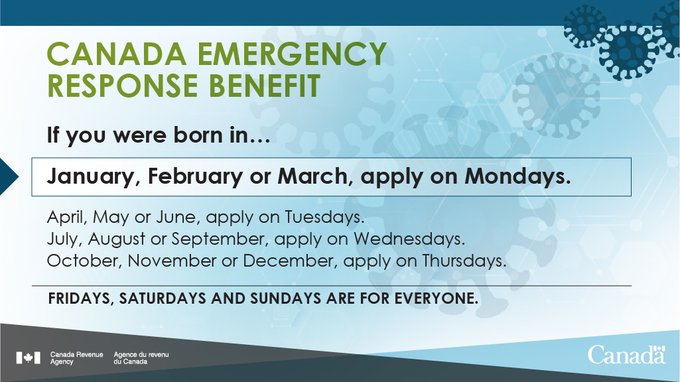

Individuals apply for CERB through CRA’s MyAccount, My Service Canada Account, or by calling an automated toll-free number 1-800-959-2019. Benefits will be received within a few days of application if you have direct deposit and within a week if you receive payment by cheque. CERB payments will be paid every 4 weeks backdated from March 15, 2020 until October 3, 2020. Because of the volume of Canadians who applied to CERB initially and are continuing to reapply for each 4 week period, CRA has been requesting that individuals apply on a certain day of the week based on when their birth month is

CERB does not apply to those covered by the federal labour code If you have questions call 1-800-O-Canada (1-800-622-6232)

Also, it's important to remember that CERB income is not taxed at source but CERB income will be included in your earnings on your 2020 tax return.

Canada Emergency Response Benefit (CERB) or EI or both?

- If you have already applied for EI, you do not need to also apply for CERB as you will be automatically moved over to CERB. Those apply for EI as a result of COVID-19 will receive the same amount as others receiving CERB irrespective of insurable hours. This is a win for many but not all. As we understand it, reporting about your current work status will be done via Service Canada if you applied originally for EI as opposed to CERB directly. Yes. Confusing.

- If required, you can use your EI hours to apply for EI benefits after you have exhausted CERB benefits (which end Oct 3/20 currently).

- If you are already on EI benefits for whatever reason your EI benefits will continue. If your EI benefits end before October 3/20 and you are unable to return to work, you can apply for CERB once your EI benefits run out

For Canadians with debt

- Potential payment deferrals, loan re-amortization, capitalization of outstanding interest arrears and special payment arrangements on a case by case basis. Contact your lender directly

- Canada Mortgage and Housing Corp (CMHC) to permit lenders a deferral of payment on CMHC insured mortgages

- Auto loans-deferrals of payments may be an option-check with bank

- CRA Debt recovery has been halted until further notice

For students or former students

Unless students lost a part time job because of COVID-19, they are likely not eligible for CERB. As announced in April 2020 and now rolled out mid May, the Canada Emergency Student Benefit (CESB) is for those currently enrolled in a post secondary program as well as new grads. who are unable to find work due to COVID-19. CESB will provide $1,250 per month for each 4-week period from May-Aug 2020. If the student has a disability or at least one dependent under the age of 12, they will receive $2,000 per month. Eligibility is based on:

- Being a Canadian citizen or permanent resident

- Studying in Canada or abroad

- Enrolled in a post-secondary education program of at least 12 weeks in duration that leads to a degree, diploma or certificate OR

- Completed or expect to complete high school in Dec 2019 OR

- Completed high school and have applied for post secondary educational program that starts before Feb 1/2020

Similar to CERB, students receiving CESB may receive income from employment or self employment income. Also an important note: You cannot apply for the CESB if you have already applied or are receiving CERB or EI

Other help for students or former students includes:

- A 6-month interest free moratorium on repayment of Canada Student loans and Ontario Student Assistance Programs (OSAP) for all individuals currently in the process of repaying student loans

- Some students with Canada Student Loans maybe able to reduce their monthly payments and have part of their loan forgiven. The Repayment Assistance Program may let you reduce your student loan repayments, depending on your household income

- Ontario Student Assistant Program (OSAP) interest and loan payments will not be required from March 30-Sept 30/2020

- Consider applying for student financial assistance to help with the cost of education if you have not already https://www.canada.ca/en/services/benefits/education/student-aid/grants-loans.html

- The Canada Summer Jobs Program is being revised to allow employers a 100% wage subsidy for jobs (full and part time) starting as soon as May 11/20 and ending as late as Feb 28/21. Interested students can apply to the government job bank https://www.jobbank.gc.ca/home

For renters

- Ontario has suspended evictions (approving new ones or enforcing evictions) during COVID-19

- The Ontario Landlord Tenant Board handles tenants rights at 1-888-332-3234

- Some communities offer low-cost loans to help cover rent

- London (519) 964-3663- x300

- Toronto (416) 924-2543

For further help in Ontario call 1-888-789-4199 (Ministry of Children, Community and Social Services) which handles benefits and financial help for Ontarians). You might also contact the constituency office of your MPP for assistance. Look them up at https://www.ola.org/en/members/current. Help in your own community might be available at 2-1-1

For Homeowners

- Property reassessments were scheduled to be completed in 2020 for updating of property taxes in 2021. However, reassessements have been postponed so the house vaulations in 2021 will be the same as 2020.

Job Protection

Employees in isolation or quarantine and employees who need to be away from work to care for children as a result of school and daycare closures will be allowed a job-protected leave under the new legislation. This measure is retroactive to Jan 25/2020

Electricity Bill Relief

- The time-of-use electricity rates for residential, farm and small-business customers will be eliminated and electricity rates will be set at the lowest off-peak price for the next 45 days. Ontario will also bar the disconnection of electricity and natural gas services for nonpayment during this time.

Confused or unsure what programs you may be able to take advantage of during this surreal moment in time? I don't blame you! it's a confusing and overwhelming time. Please feel free to reach out and connect and I will do my best to assist

Brenda