Markets tend to revert to their average performance over time.

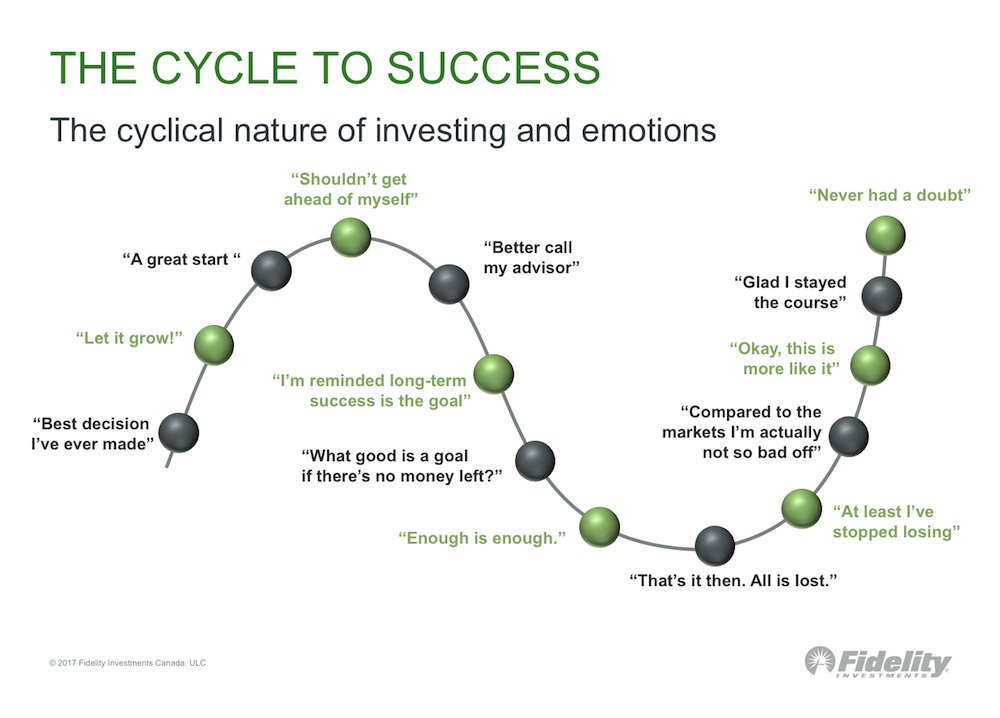

It's been quite a week so far as markets (and the media) have been rattled by the financial impact of the Coronavirus which reminded me of this graphic from Fidelity that I found in my files and thought I would share. Life on the financial market roller coaster! Market corrections can be really hard to endure, but they're not a uncommon occurrence. There have been 37 corrections in the market of more than 10% since 1950. Prior to this past week, markets were on a real tear, climbing to record 15 year highs. But this week the market has been rattled significantly by both the spread of the Coronavirus and apprehension around how high the market has risen. You can probably add in some anxiety about the upcoming US election while we're at it.

When markets are up everyone is happy. When markets go down, fear and panic can set it pretty quicly and dramatically which has been accentuated in the past few years by algorithms working overtime. While I can't predict how big and how long this correction will last here are some things I do know:

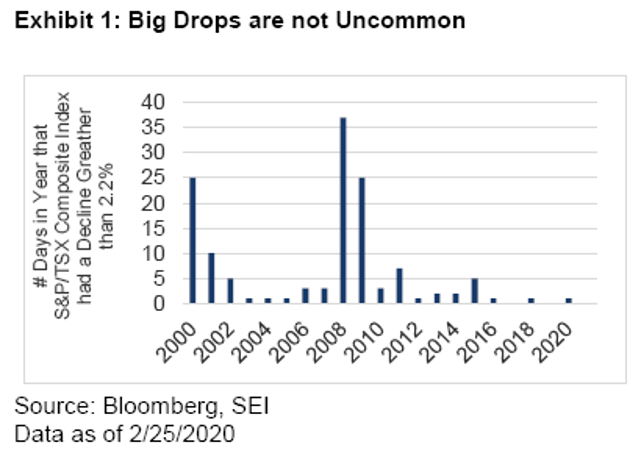

Stock markets go up and they go down. Always. Economies are cyclical, and they expand and contract which is why the market is not always stable. But sometimes instability can as we have witnessed this week, be caused from an unpredictable outside event like a Coronavirus which acts as a tipping point. Over the past 20 years, there have been lots of downward moves occurring several times a year (see the chart above).

We're down from a high. The market has been on a (net) upward trend for a long while. It's been the longest bull market ever and it's been nice that's for sure. Just a few months ago we were celebrating the fact that the S&P500, Dow Jones and Nasdaq had closed 2019 with gains of between 22-35%. Currently, The S&P/TSX Composite is still up (net) 10.4% over the year ending Feb 25/2020 and net of 7.1% over the past decade, even with the recent drops. Same story for the Dow Jones which dropped significantly this week but has still gained 6.3% (net) over the last year and a (net)12.9% over the last decade. All is not lost. Major equity markets are still above where they started the 4th quarter of 2019 despite the sharp decline over the last few days.

Emotion moves markets. Most corrections, are driven by a lot of emotion. This one is no different and probably worse as there's lots of attention and fear about a potential pandemic. But it's important to remember that there have been 18 times that the market has fallen 5% off it’s high since the market started climbing back since 2009. Oh, we remember 2008/2009. I don't think this is 2008/2009.

Your portfolio is not the index. When the media talks about the market being off 5%-10% this week they are talking market weighted indexes like the S&P/TSX Composite, the S&P 500 or MSCI all-country global index. But your portfolio would only have declined by that amount if you’re all in on equities. If you’re all in on equities-you should talk to a financial planner

Predicting the future is hard. No one can predict with 100% accuracy especially over the short term. Over the medium term, stocks generally go up. Over the long term they go up.

Know your risk tolerance. Your risk tolerance is personal. Higher returns come with higher risk but if you're worried about a 5% correction you probably should be in cash or GICs. If you want more stability and less volatility, then you should have less equities in your portfolio in favour of fixed income and should expect lower returns. If you are close to retirement or if you plan on spending the money in your portfolio within the next couple of years, you should not take on a lot of risk and should be reducing your equity exposure accordingly. You need to sleep at night. Act accordingly and talk to your advisor/financial planner.

Be like Warren Buffet The most successful investors are well diversified, optimistic and patient and they know their tolerance for risk and their portfolios will be balanced accordingly. It’s important to review, rebalance and reposition between asset classes at least 1-2 times per year especially when equity markets are performing well because the equity portion of your portfolio will grow faster. Life is busy but your financial planner should be reaching out to you to make sure you are rebalancing. That’s the job they are paid to do except of course if you’re dealing with a robot that does not provide financial planning services

Time in the market not timing is key. The longer you are in the market, the better your chance of success. So, when a market correction occurs, it's important not to panic unless you are a very short term investor.

There is no such thing as a perfect portfolio. However, diversification and asset allocation are critical to ensuring that not everything in your portfolio goes down at the same time. Equities are down right now but the loss in your portfolio is being mitigated by the fixed income or alternative investments in your portfolio. Those lesser yields offered by fixed income are hard to appreciate except when those assets buffer you from greater declines. Diversification across sectors and countries also matters. As an example, this period of volatility is particularly hard for public companies like airlines, hotels, travel operators, mining and luxury goods retailers especially in Asia. That’s why you need to be diversified at all times across multiple industries/sectors and across different countries.

It's not over until it's over. There is every reason to believe business activity will return to normal after the virus runs its course as long as the fundamentals are in place and consumer confidence is positive. In the meantime, we can probably expect the steady flow of coronavirus-related uncertainty to persist and cause more volatility (and anxiety) in the near term. Uncertainty in the market right now is leadng to all sorts of speculation. The big uncertainty is about how long this virus will last as well, how severe it will get and what the financial impact on companies that trade in the market will be. No one has the answers. The market impact of SARS was largely limited to one or two quarters but it’s hard to compare since a lot has changed in global markets since 2003. More than 60% of market corrections in the past lasted 104 or fewer days.

Market corrections are really no fun. Nobody likes to see their investments decline but if you’re thinking about selling now your losses are permanent and eventually you will have to make the decision about when to get back in. (Go back to note 4) But while, it's hard to predict when the market will start climbing again, the decrease in prices does provide a good buying opportunity that wasn't there before the correction. Look for investment opportunities that show a history of strong earnings, a solid balance sheet and income not just growth

The market is indeed, hard to predict-up or down. No one knows until they know. Generally, if you're a long-term investor the bumps along the way will not have a long term impact and this correction may provide good opportunities to rebalance and buy on sale. There is a potential for short term losses during these brief periods of corrections, but the market generally leans toward stability. That's why it's also important to have a financial plan in pace that is realistic and not built based on high expectations. The financial plans I build are reasonable and based on 4-6% returns in the market and will vary based on a client's risk tolerance.

Happy surprises beat unhappy surprises any day of the week and positive returns are way more fun for all of us than negative returns.