Sharing details about personal finances with your partner will make you happier and more attractive

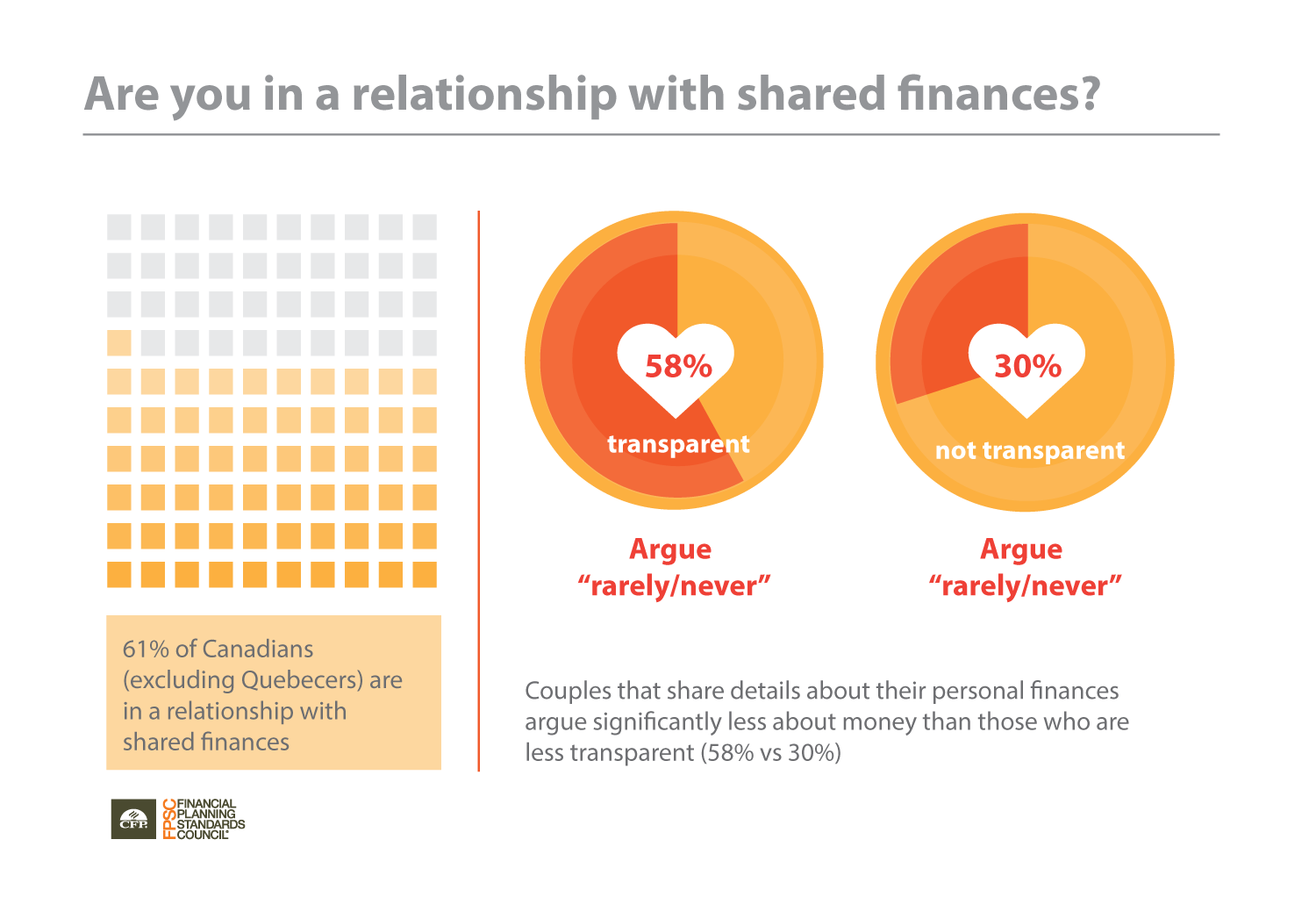

That's the results of two different surveys. A national survey conducted by Leger on behalf of the Financial Planning Standards Council (FPSC) found a link between financial transparency and happy, successful relationships. It showed that couples that share details about their personal finances argue significantly less about money than those who don't (58% vs. 30%). While a recent Experian Consumer Services survey on Love & Marriage in the US, indicated that 73% of women and 60% of men think that open communication with their spouse or partner about finances makes him or her more attractive.

It's not just about Romance it's about Finance

Money is the number one issue married couples fight about and the second leading cause of divorce. No matter how much you might love your spouse, merging your lives and money together is a lot of work and a family’s emotional & physical survival often hinges on financial stability. That makes money management & open communication about money critical. In combination with sharing details about family finances, it’s just as important for couples to define and agree on their mutual financial and life goals together in order to make wiser choices in the years ahead to reach those goals.

Success comes from being on the same page as your spouse when it comes to money but it's not happening...

The Leger study found that about 61% of Canadian couples share their finances together but found only about half of Canadians (54%) talk to their partners about personal finance. 7% of those surveyed admitted that they have lied to a spouse or partner about money matters. The Experian survey from the US showed that only 39% of married adults were sharing responsibility for their family finances.

In too many families, spouses take on defined roles where one spouse takes on the role of being the CFO/Admin person and the other becomes very reliant on that CFO spouse to manage the family finances and keep it all ‘together’. It might work; but it’s a real risk and not an ideal situation. It can increase the pressure & responsibility that one spouse feels with managing all that information while the other spouse is left dangerously vulnerable. That creates an imbalance and stress. Open communication around family finance can help a couple avoid conflict and can prevent one spouse from feeling like they are carrying more of the burden over time.

Not sharing details about finances also comes with financial risk of assets becoming lost or forgotten

As an advocate for consumer protection legislation and an expert on the issue of Unclaimed financial property, I can attest to the fact that not sharing information around financial details comes with much financial risk. Without your spouse being aware of all of your financial holdings, those assets could easily be added to the estimated $6-$7 Billion (and growing) balance of unclaimed financial assets in Canada. The majority of Canadians are not protected with unclaimed financial property legislation to help find forgotten or missing financial assets. That makes sharing the details around your financial holdings even more critical.

Here is a list of some of the details that are important to document and share with each other:

- Assets: including bank accounts, registered/non-registered investments, safety deposit boxes, prepaid funeral deposits, real property, personal property & business assets etc.

- Liabilities—including loans, credit card debt, mortgages, lines of credit, business liabilities etc.

- Contacts-including medical contacts, professional advisors and family

- Digital Assets-including loyalty & reward programs, logins & passwords etc.

- Insurance-including disability, property, life, group as well as home & auto

- Estate Planning —including Power of Attorneys, Wills, Ethical Wills, Prepaid funeral deposits, Final wishes, etc..

This I know from working with many couples over the years: When both spouses have this information at hand or know where to find it, it will lead to more peace of mind for both in case a "What if" scenario involving a physical or natural disaster or a death or incapacity were to happen. But, sharing the details is mostly about living. Sharing important financial details with each other and working towards mutual goals and objectives will allow you both to be more proactive and successful in reaching those goals. It can help move you forward in all sorts of ways.

So what if we all used Valentine’s Day to really open that conversation with our spouse about mutual finances and future life goals?

Dim the lights, put on your favourite music, make a beautiful dinner and talk about your vision for the future and how together you can get there. That would save some money as opposed to going out tonight and maybe lead to greater happiness and greater success in reaching your financial goals.

Let me know if you need some help (after Valentine’s Day) to make it all happen.

Happy Valentine's Day